The president of the San Francisco Fed stated the massive improve in new U.S. jobs in January made for a “wow” report, however she burdened that the central financial institution wants extra data earlier than it decides how a lot additional to lift rates of interest.

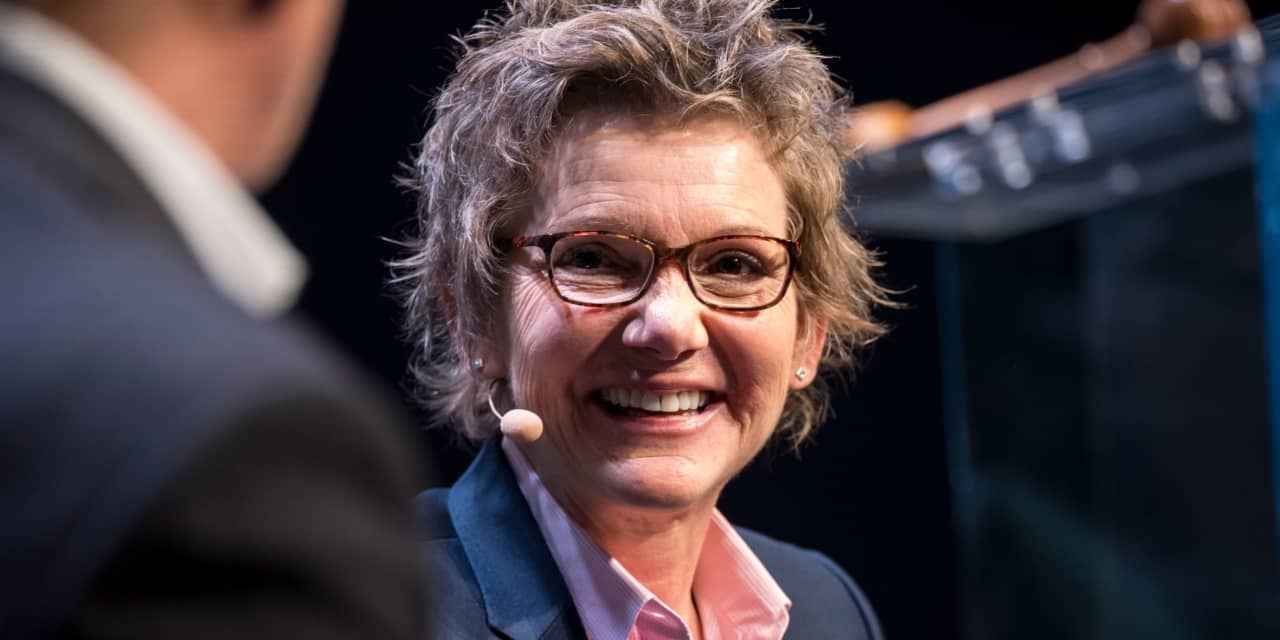

“What I am seeing is a strong labor market,” Mary Daly stated in an interview aired on Fox Business.

Yet she additionally stated it’s untimely to attract conclusions. The Fed must see extra knowledge on the financial system, she reiterated, earlier than figuring out its subsequent step.

The financial system created some 517,000 new jobs in January, the federal government stated Friday, a rise in nonfarms payrolls that was 3 times the achieve that Wall Street had forecast.

Commentary by Rex Nutting: The blowout jobs report is definitely 3 times stronger than it seems

The stunningly robust report renewed speak that the Fed would possibly elevate its coverage rate of interest a number of extra occasions as a part of its combat to slay inflation. A good labor market has pushed up wages over the previous two years on the quickest tempo in 4 many years.

The jobs report did present additional moderation in wage positive aspects — one thing the Fed needs to see. The improve in hourly pay over the previous 12 months slowed to 4.4% in January from 4.8% within the prior month and a latest peak of 5.9%.

“My outlook for inflation is for it to come down,” Daly stated. “Right now I see some positive signs, but it’s far too early to declare victory.”

The Fed on Wednesday raised its benchmark rate of interest, the newest in a string of hikes, in an effort to sluggish financial development simply sufficient to mood inflation with out plunging the financial system into recession.

Fed officers have made it clear, although, that they may do what it takes to get inflation again right down to pre-pandemic ranges of two% or so. The yearly fee of inflation stood at 6.5% in December, primarily based on the patron value index.

Higher rates of interest are inclined to sluggish the financial system by elevating the price of borrowing for bank cards, mortgages, automotive loans and different shopper and enterprise loans.

Daly will not be a voting member this 12 months on the Fed’s panel that raises and decrease rates of interest.

Source web site: www.marketwatch.com