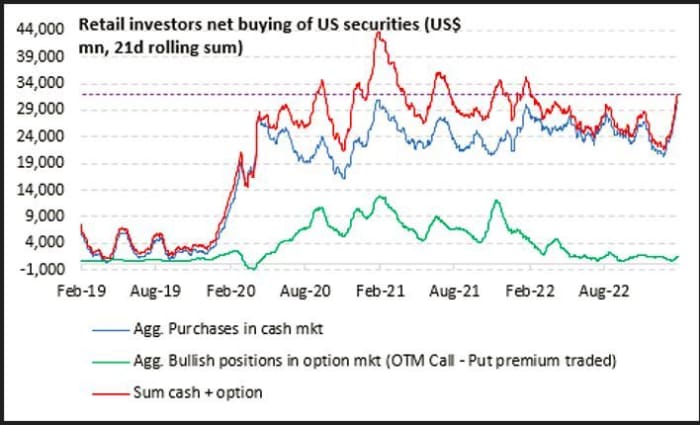

While knowledge exhibits particular person buyers dusting themselves off and shifting again into the inventory market this yr, alas their love for Wall Street is uneven.

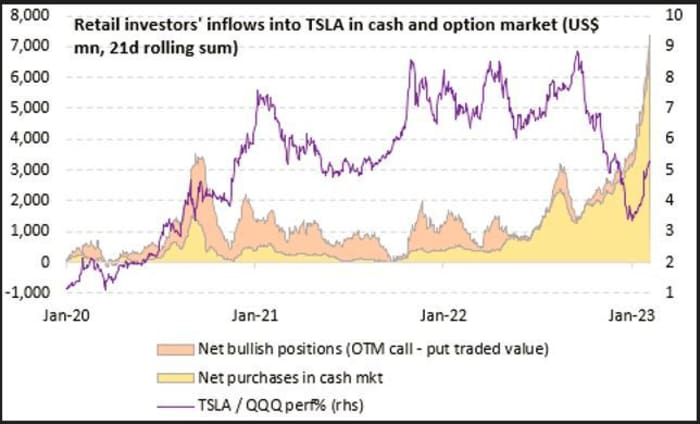

That’s in keeping with Vanda Research, which factors out that whereas retail investor inflows into U.S. shares are at ranges final seen in 2020-21, the transfer has has been dominated by Tesla Inc.

TSLA,

whose shares noticed their worst-ever efficiency in 2022, and shares uncovered to a scorching new expertise.

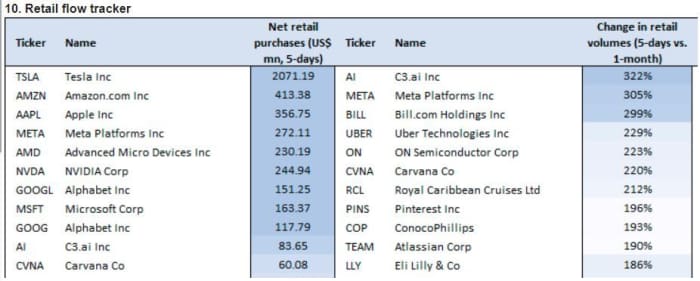

“Tesla shares are experiencing an unprecedented surge in demand, and to a lesser extent, so are artificial intelligence-related stocks like NVDA and AI, as well as the rest of FAANG group,” stated Marco Iachini, senior vp, Giacomo Pierantoni, head of knowledge and Lucas Mantle, knowledge science analyst, in a Thursday notice, utilizing ticker symbols for Nvidia Corp.

NVDA,

and C3.ai Inc.

AI,

Read: These 20 AI shares are anticipated by analysts to rise as much as 85% over the following yr

“If flows into cash equities sustain the current pace, we believe there is scope for the more speculative retail traders to pick up the slack in the options market too — where activity has been muted over the last year,” stated the staff in a notice to purchasers.

Vanda Resarch

That stated, the analysts see worry of lacking out (FOMO) and momentum driving flows, making the scenario totally different from early 2021 and leaving particular person buyers “susceptible to negative catalysts.”

“That said, should macro conditions remain favorable in the near term, we do not exclude a continuation of speculative activity in AI-related stocks or other niches of the market,” stated the Vanda Research staff.

Major inventory indexes have bounced strongly to start 2023, with the tech-heavy Nasdaq Composite

COMP,

up practically 15%, whereas the S&P 500

SPX,

has bounced 8% and the Dow Jones Industrial Average

DJIA,

has gained 3.2%.

JPMorgan reported final month that retail market orders as a p.c of market worth reached 23% on Jan. 23, which compares the 22% seen a couple of occasions again when GameStop shares

GME,

began hovering and Roaring Kitty and Reddit Wall Street Bets was the speak of the watercooler in early 2021.

Markets are additionally seeing a rebound in complete buying and selling turnover, versus the second half of final yr when secure day by day internet shopping for was accompanied by declining buying and selling quantity as buyers centered on disciplined longer-term shopping for. The bounceback suggests improved danger urge for food and “option volumes could pick up next, albeit not to the same extent, given that a large share of the WSB/degen crowd is likely still licking their wounds from 2022,” stated the Vanda staff, referring to the favored wallstreetbets Reddit discussion board.

In order to see buying and selling increase past Tesla and AI shares, they stated the market wanted to see continued U.S. financial resilience and particpation by “fast money discretionary managers,” together with extra shopping for by mutual funds and pensions.

In the meantime, hopes for a smooth touchdown and not-too-hot, not-too-cold economic system is prone to preserve the cash flowing. That traces up with insights from JPMorgan, who famous important participation these days by older buyers, who will possible preserve shopping for shares and bonds except optimism over inflation fades.

According to JPMorgan, older buyers, who have a tendency to take a position through trade traded funds, have injected $81 billion into bond funds and $44 billion into fairness funds to date in 2023, towards final yr once they offered “unprecedented $340 bilion of bond funds and bought no equity funds,” stated strategists led by Nikolaos Panigirtzoglou.

As for Tesla flows, Vanda Research famous that within the newest week, the EV maker drew a 24% and 33% share of single inventory and general internet purchases throughout all U.S. securities, respectively. While they see buyers “chasing momentum in the stock aiming to recoup 2022 losses,” the features additionally come as hopes construct forward of Tesla’s March 1 investor day.

Vanda Research

As for AI (synthetic intelligence) associated shares, in every week that has delivered news on chatbots from Alphabet’s Google

GOOGL,

Microsoft

MSFT,

and Baidu

BIDU,

the Vanda staff famous giant retail internet inflows over the previous few days continued to circulation into C3.ai, although that has begun to gradual some. Retail buyers are additionally sticking cash into associated small-cap shares, comparable to BigBear.ai

BBAI,

or SoundHound AI

SOUN,

Read: Meme shares and hashish had been investing fads, however Morgan Stanley says AI is the actual deal

Plus: Microsoft nonetheless has ‘a mountain to climb’ regardless of AI and ChatGPT efforts

And Nvidia

NVDA,

and Microsoft may very well be subsequent to attract the massive investor curiosity. “Should TSLA’s stock price continue its rapid ascend, leading retail traders to lock in profits or avoid adding further exposure, we expect demand to turn to NVDA and MSFT as alternative investment options,” stated the Vanda staff.

Vanda Research

Source web site: www.marketwatch.com