Out of 11 periods to date this yr, the S&P 500

SPX

has managed to shut greater in three (and one simply barely). But after all, the yr is younger.

As for the bond market, the final two years haven’t been wonderful for traders, however some are predicting 2024 to be the yr of the bond, partly as a result of the asset class tends to shift into favor when the Fed’s price climbing cycle is over.

Bonds over shares this yr is the way in which to go, says our name of the day from Nadège Dufossé, world head of multiasset at Candriam, an asset-management firm and subsidiary of New York Life.

With shares, “you are not paid for the risks you take. In the bond market, you have an expected return that is not very high, but you have a lower risk level and certainly your bonds will edge your equity if you have both in a diversified portfolio,” Dufossé instructed MarketWatch in an interview on Wednesday.

Unlike some, she doesn’t count on six or seven Fed price cuts this yr. Such a path “would mean that the economic growth would be weaker than expected. So if you have some positive surprise on the bond side because you have yields decreasing, you will have negative surprises on the equity side because [earnings per share] growth will be negative and the equity market will go down,” stated Dufossé.

In a separate word, she laid out their choice for presidency debt, equivalent to dollar-denominated debt with forex hedging, and funding grade company credit score in euros and {dollars}, in addition to emerging-market debt, which ought to do okay in a world of slowing but constructive development and a weak greenback.

But the agency is staying invested in equities, the place it suggests traders stay nimble sufficient to catch some entry factors and hopefully get their timing proper. In 2023, she stated the agency started extra constructive than consensus on shares, which paid off “because markets were strong at the beginning of the year.”

“But I would say like many investors, we underestimated the upside on equity markets,” going impartial within the second quarter, which was too early stated the supervisor. That was very true for U.S. tech, the place it went obese early within the yr, however then shifted unfavorable too quickly, earlier than ending the yr at obese, the place it now stands.

“On the bond side, we were OK because we increased the duration at the end of the year,” she stated, including that it additionally constructive on credit score, which labored out properly.

In phrases of EPS development expectations, she expects U.S. tech shares will doubtless hold outperforming, including that the interest-rate setting shouldn’t be an impediment for valuations. She additionally likes defensives, equivalent to healthcare, which was a guess that didn’t work out for them final yr, however which is already doing higher this yr.

It additionally went constructive early on Chinese and European equities, however timed an exit out of these in April and May of 2023, which proved a savvy, she stated, however word she’s nonetheless not prepared to maneuver on China.

“And we are also trying to find an entry point on small caps, but it’s more a matter of timing right because we consider that small-cap valuation is really attractive,” stated the supervisor, of the asset class that suffered “sometimes forced and undifferentiated selling” final yr, each within the U.S. and Europe.

“And when all the weakening of economic growth will be integrated in markets, it will be the right time to really buy small-caps,” she stated.

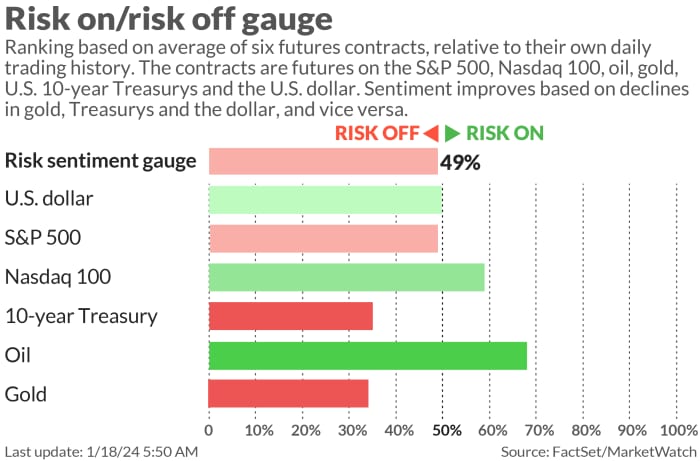

Dufossé says for a diversified portfolio, rising inflation “would be the worst-case scenario,” placing bonds and equities in danger for a downturn equivalent to seen in 2022. “In this case, liquidity and exposure to certain commodities such as gold or energy (oil) should be favored to limit the decline,” she stated in a separate word to shoppers earlier this month.

The markets

Stock futures

ES00,

NQ00,

are rising, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

decrease.

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,739.21 | -0.92% | 0.87% | -0.64% | 20.63% |

| Nasdaq Composite | 14,855.62 | -0.76% | 0.53% | -1.04% | 35.58% |

| 10 yr Treasury | 4.087 | 11.59 | 20.02 | 20.65 | 68.78 |

| Gold | 2,014.60 | -0.91% | -2.09% | -2.76% | 4.18% |

| Oil | 73.2 | 0.48% | -0.99% | 2.62% | -9.45% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The buzz

Earnings are forward from Northern Trust

NTRS,

Truist Financial

TFC,

KeyCorp

KEY,

and Fastenal

FAST,

Discover shares

DFS,

are sliding on revenue disappointment because the credit-card large additionally units apart one other $1 billion to protect in opposition to souring credit score.

Chip maker TSMC

2330,

TSM,

reported a 19% revenue drop within the fourth quarter, however beat forecasts. U.S.-listed shares are climbing.

Earnings preview: Netflix’s advert mannequin and sharing crackdown are paying dividends

Weekly jobless claims, the Philly Fed manufacturing survey and housing begins are all due at 8:30 a.m. Atlanta Fed Pres. Raphael Bostic will converse at 7:30 a.m., then later once more at 12:05 p.m.

The U.S. Treasury will public sale $18 billion of 10-year TIPS, or inflation-protected securities, at 1 p.m.

Best of the net

Can AI and a supercomputer beat the markets? This is likely one of the hedge funds looking for out.

How China crypto merchants are skirting the principles.

Why one in all most gifted fund managers of his era made enormous bets on a infamous financier.

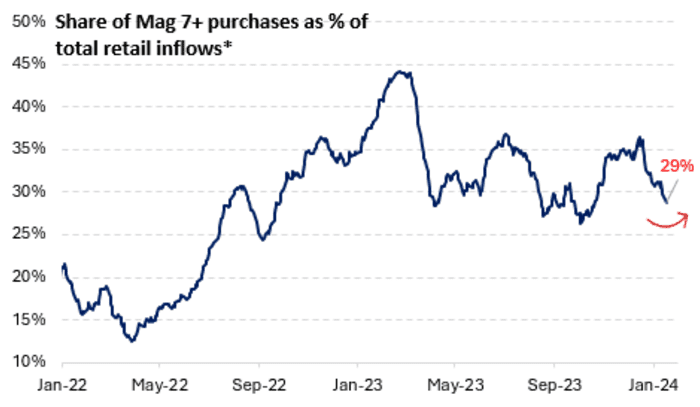

The chart

As huge tech earnings will begin rolling out over the subsequent two weeks, traders are more likely to begin placing a refund into these names, predict Vanda Research analysts, who supply this chart:

*Mag 7+ embody AAPL, AMD, AMZN, GOOG/L, META, MSFT, NFLX, NVDA, TSLA

Source: VandaObserve, Vanda Research

They word that knowledge will matter as a worsening danger backdrop may imply extra tech inventory shopping for, and in-line knowledge will imply average inflows to the sector.

Top tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

TSM, |

Taiwan Semiconductor Manufacturing |

|

NIO, |

Nio |

|

AMD, |

Advanced Micro Devices |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

PLUG, |

Plug Power |

|

MSFT, |

Microsoft |

Random reads

Kanye pays $850,000 for Bond-like titanium dentures

Dairy firm can pay $10,000 when you ditch your cellphone for a month.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com