The inventory market, as measured by the S&P 500 Index

SPX,

), has been shifting upward. The U.S. benchmark index is actually crawling up the upper “modified Bollinger Bands” (mBB), which is a little bit of an overbought situation, however not a promote sign.

The subsequent main resistance seems to be within the 4650 space, which at one time appeared far-off however is now inside vary. There is minor assist at 4527 (final week’s lows), with stronger assist beneath that, at 4440, 4385, 4330 and 4200. Given the sturdy upward momentum of the market, a few these might be violated with out giving the bull market any downside, however a fall beneath 4330 can be a sport changer.

The S&P 500 has lately closed above the +4σ mBB, which units up a “classic” promote sign. That “classic” sign was generated on Thursday when SPX closed beneath the +3σ Band — 4560. But we don’t commerce the “classic” indicators, preferring to attend for the additional affirmation of a McMillan Volatility Band (MVB) sign. Just as a result of a “classic” promote sign has occurred doesn’t imply {that a} MVB promote sign will mechanically comply with. We will maintain you updated on these developments weekly.

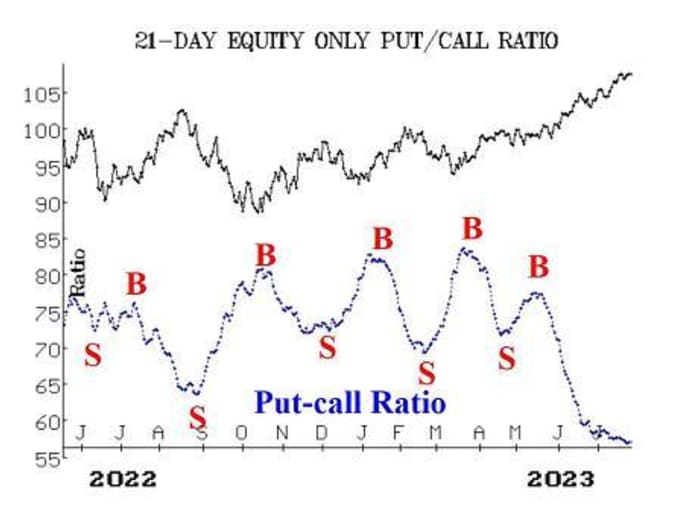

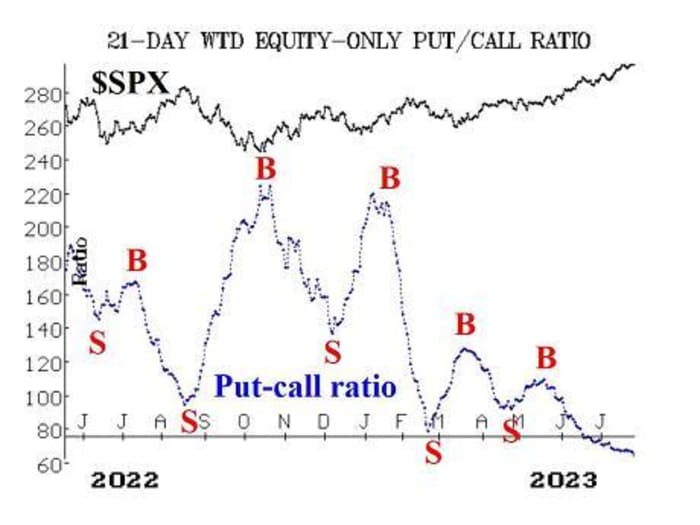

Equity-only put-call ratios have continued to edge decrease as shares have risen. This signifies that the put-call ratios are nonetheless on purchase indicators, however they’re in deeply overbought territory as a result of they’re so low on their charts. The pc packages that we use to investigate these charts are as soon as once more warning of a promote sign, however we desire to attend till we will visibly see the ratios start to rise earlier than taking over any damaging place based mostly on these ratios. Despite the truth that these ratios are at lows for the final yr or so, it ought to be famous that they have been a lot decrease all through the 2021, as that bull market was urgent ahead, and finally gave option to a bear market.

Market breadth has been typically optimistic. Both breadth oscillators are on purchase indicators and are in overbought territory. They might face up to a day or two of damaging breadth and nonetheless stay on these purchase indicators. Perhaps extra importantly, cumulative quantity breadth (CVB) is approaching what might be a serious purchase sign. If CVB makes a brand new all-time excessive, then SPX will comply with. CVB is inside only a small distance of its all-time excessive and will attain that as we speak. Doing so would imply that an upside goal of 4800+ can be in drive for SPX.

New Highs on the NYSE proceed to dominate New Lows, so this indicator stays strongly optimistic for shares.

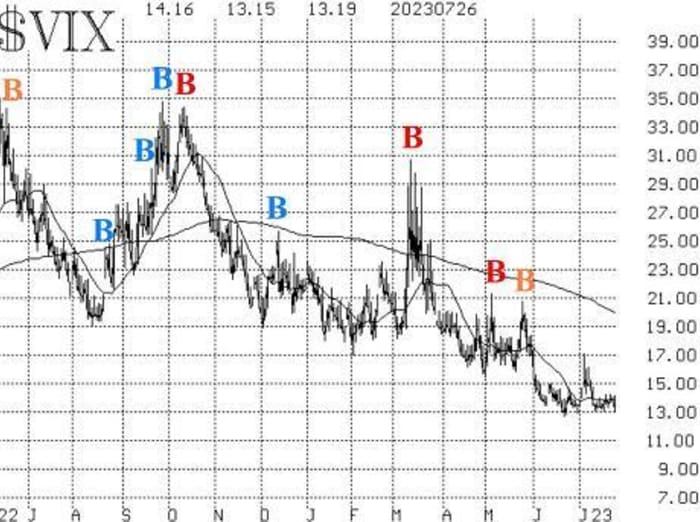

VIX

VIX,

is languishing between 13 and 14. As lengthy as this continues, shares can rise. The solely time issues would floor can be if VIX spurted greater. So far, that hasn’t occurred. It seems that “big money” nonetheless has some worry of this market, so they’re shopping for SPX places, retaining VIX a bit elevated. It must also be famous that VIX usually makes its annual low in July and begins to rise in August. So that may be a doubtlessly damaging seasonal issue on the horizon.

The assemble of volatility derivatives stays bullish for shares, because the time period constructions of each the VIX futures and of the CBOE Volatility Indices proceed to slope upwards.

Overall, we’re sustaining our “core” bullish place due to the bullish SPX chart. We are elevating trailing stops and rolling deeply in-the-money calls upward as we go alongside. Eventually, we are going to commerce different confirmed indicators round that “core” place.

New suggestion: Potential CVB purchase sign

We made this suggestion final week and advisable utilizing the cumulative whole of each day NYSE advancing quantity minus declining quantity as a information. That cumulative whole did attain our projected worth as of July 26. In actuality, the “stocks only” CVB ended simply shy of a brand new all-time excessive. We are going forward with the advice, because the means that we acknowledged it final week did generate the purchase sign.

Buy 4 SPY Sept (29th) 480 calls: Since CVB reached a brand new all-time excessive, we’re going to purchase SPY

SPY,

calls with a putting worth equal to SPY’s all-time excessive. We will maintain with no cease initially.

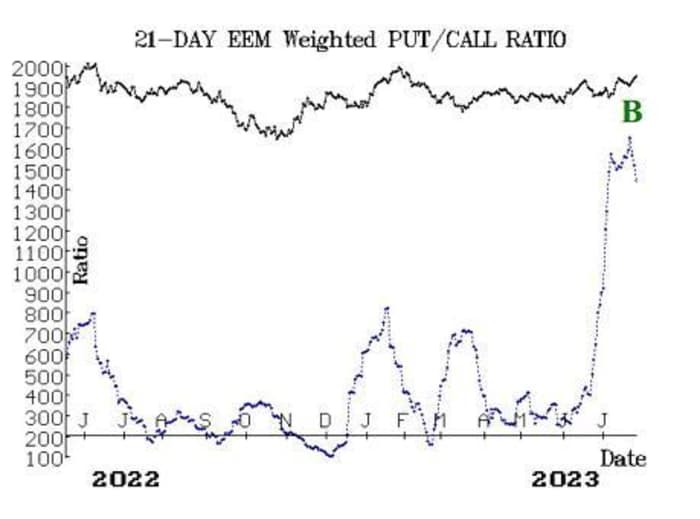

New Recommendation: Emerging markets ETF (EEM)

There has been a high-level purchase sign generated from the weighted put-call ratio for the Emerging Markets ETF

EEM,

Put shopping for has been extraordinarily sturdy for greater than a month and is now’s abating. This has generated the purchase sign.

Buy 5 EEM Oct (20th) 41 calls in line with the market

We will maintain these calls so long as the EEM weighted put-call ratio stays on a purchase sign.

Follow-up motion:

We are utilizing a “standard” rolling process for our SPY spreads: in any vertical bull or bear unfold, if the underlying hits the brief strike, then roll the whole unfold. That can be roll up within the case of a name bull unfold, or roll down within the case of a bear put unfold. Stay in the identical expiration and maintain the space between the strikes the identical until in any other case instructed.

Long 800 KOPN:

KOPN,

The cease stays at 1.70.

Long 2 SPY Aug (4th) 453 calls: This is our “core” bullish place. The calls have been rolled up 3 times. Stop out of this commerce if SPX closes beneath 4330. Roll up each time your lengthy SPY choice is at the very least 6 factors in-the-money.

Long 1 SPY Aug (4th) 453 name: Bought in keeping with the “New Highs vs. New Lows” purchase sign. The calls have been rolled up 3 times. Stop out of this commerce if, on the NYSE, New Lows outnumber New Highs for 2 consecutive days. Roll up each time your lengthy SPY choice is at the very least 6 factors in-the-money.

Long 2 PFG Aug (18th) 80 calls: This place has been was rolled up twice. We will maintain this PFG

PFG,

place so long as the weighted put-call ratio stays on a purchase sign.

Long 10 VTRS

VTRS,

August (18th) 10 calls: The cease stays at 10.15.

Long 5 CCL

CCL,

Aug (18th) 17 calls: Raise the cease to 17.10.

Long 2 PRU

PRU,

Aug (18th) 87.5 calls: We will proceed to carry these calls so long as the weighted put-call ratio stays on a purchase sign.

Long 8 CRON

CRON,

Aug (18th) 2 calls: Hold these calls with no cease whereas takeover rumors play out.

Long 6 ORIC

ORIC,

Aug (18th) 7.5 calls: The cease stays at 7.40.

Long 2 EW

EW,

Aug (18th) 95 places: Continue to carry these places so long as the weighted put-call ratio stays on a promote sign.

All stops are psychological closing stops until in any other case famous.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan could maintain positions in securities advisable on this report, each personally and in shopper accounts. He is an skilled dealer and cash supervisor and is the creator of the best-selling guide, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The data on this e-newsletter has been rigorously compiled from sources believed to be dependable, however accuracy and completeness usually are not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals could have positions within the securities advisable within the advisory.

Source web site: www.marketwatch.com