Most U.S. house loans find yourself within the almost $9 trillion marketplace for residential mortgage bonds with authorities backing, a crucial nook of housing finance that boomed within the wake of the subprime-mortgage disaster.

The “agency” mortgage-bond market resembles the roughly $25 trillion Treasury securities market in that it gives a number of the lowest borrowing prices out there, and in that defaults are thought of unlikely as a result of the bonds include U.S. authorities backing.

Fitch Ratings on Tuesday adopted by way of with a May risk to chop the U.S. debt score, pointing to “fiscal deterioration” anticipated over the following three years in addition to the federal government’s massive and rising debt burden and the “erosion” of governance, together with by way of “repeated debt limit standoffs and last-minute resolutions.”

A day later it additionally lowered the highest AAA debt rankings of housing giants Freddie Mac

FMCC,

and Fannie Mae

FNMA,

by a notch to AA+, saying, “firms continue to benefit from meaningful financial support from the U.S. government,” but additionally that the transfer wasn’t pushed by a deterioration in credit score, capital or liquidity on the companies.

Stocks fell Wednesday, with the S&P 500

SPX

reserving its sharpest day by day proportion decline since April, whereas the 10-year Treasury yield

BX:TMUBMUSD10Y

rose to almost 4.1%, as traders targeted on the Treasury’s massive $1 trillion borrowing plan for the third quarter.

Here’s what to know in regards to the greatest a part of the U.S. housing finance market now that Fitch has turn into the primary main credit-rating agency to decrease the U.S.’s AAA credit standing to AA+ since S&P Global lower its score in 2011.

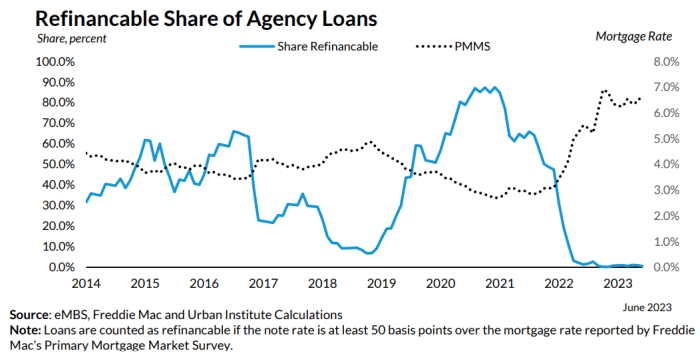

Refi wave is a giant buffer

The good news is that almost all U.S. owners already refinanced in the course of the pandemic because the 30-year mounted mortgage fee fell to a 2.68% low in December 2020 from 4.87% in November 2018, in accordance with knowledge from the Urban Institute.

That gives a cushion for owners sitting tight with ultralow mortgage charges, sparing them the brunt of the Fed’s rate-hiking marketing campaign.

It additionally ought to restrict any reverberations from Fitch’s determination to not apply its prime rankings to U.S. debt. The chart beneath drives the purpose house, displaying that nearly no mortgages are ripe for refinancing with charges hovering round 7%.

The share of U.S. house loans able for refinancing has fallen to nearly zero.

eMBS, Freddie Mac, Urban Institute

Mortgage-backed securities a ‘haven play’

Agency mortgage bonds proceed to be considered in monetary markets as a safe-haven play. Like the rally within the Treasury market in 2011 following S&P Global’s shock downgrade of U.S. credit score, Fitch’s score transfer might be a shot within the arm for company mortgages.

“I would not expect this downgrade by itself to have a meaningful impact on the spreads attaching to agency [mortgage-backed securities],” stated Yesha Yadav, a professor of legislation at Vanderbilt University, including that the sector staged a strong rally following the S&P Global downgrade roughly a decade in the past.

Spreads are the premium traders are paid on bonds above the risk-free Treasury fee, whereas additionally serving as a gauge of threat sentiment.

“Of course, there may be broader concerns surrounding the housing market and possible defaults arising out of higher rates,” Yadav stated.

She additionally flagged a “larger and deeper worry” signaled by Fitch in its downgrade: How a lot can traders proceed to belief the default-free fame of U.S. Treasury securities with Congress persevering with to make use of U.S. credit score rankings as a “bargaining chip in negotiations”?

U.S. debt load in focus

Agency mortgage bonds are swimming pools of house loans which might be underwritten to stricter credit score requirements than prevailed within the run-up to the 2007-2008 international monetary disaster. U.S. housing giants Freddie Mac and Fannie Mae don’t make house loans, however they do purchase ones that match their tighter lending standards and concern swimming pools of bonds with the implicit backing of the U.S. authorities.

Freddie and Fannie didn’t instantly reply to a request for remark. Fitch didn’t reply to a request for remark for this text.

Read: What Fitch’s U.S. credit score downgrade means for traders

While monetary markets are largely anticipated to shake off the U.S. dropping its prime AAA debt score for a second time in roughly a decade, it may usher in a interval of larger “fiscal austerity,” with the lowered rankings more likely to turn into “a political lighting rod,” in accordance with Oxford Economics.

Also, whereas the Federal Reserve might have only some extra fee hikes in its arsenal earlier than it calls it quits on its inflation battle, the mortgage business is tethered to fluctuations in longer-dated Treasury yields.

Scott Buchta, head of fixed-income technique at Brean Capital, informed MarketWatch the Fitch downgrade of the U.S. seems to be much less regarding than the potential for volatility within the mortgage market from increased Treasury yields on the again of heavy new provide.

The Treasury earlier this week stated it expects to borrow about $1 trillion within the third quarter, an quantity that Vivien Lou Chen writes is the biggest ever for that timeframe and a possible supply of ache for traders.

“A bigger concern for the mortgage market is the amount of debt that’s expected to be issued,” Buchta stated.

Read: New Jersey home costs rise at quickest fee within the nation — however different states noticed costs fall by as much as 8%

Source web site: www.marketwatch.com