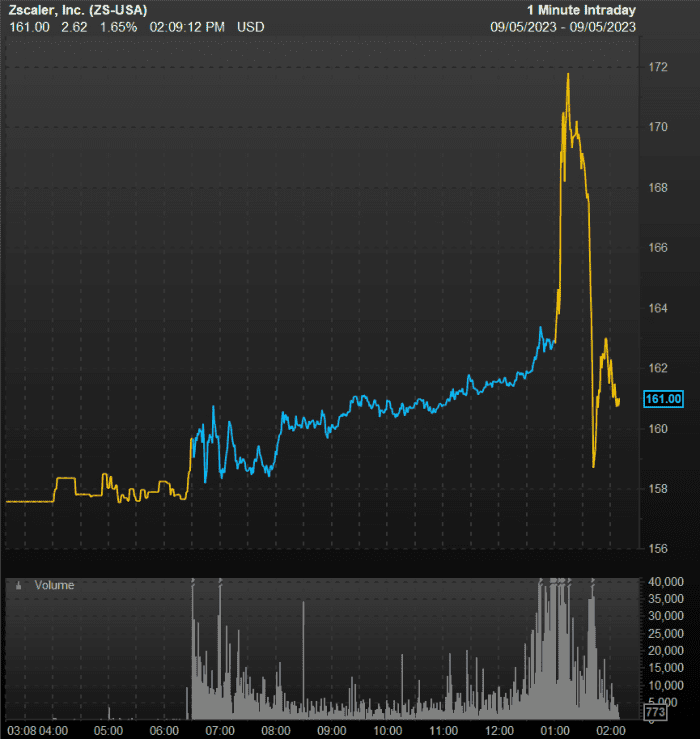

Zscaler Inc.’s shares swung to a loss within the prolonged session Tuesday after the cybersecurity firm’s sturdy quarter and outlook topped Wall Street’s expectations however executives mentioned offers had been taking longer to shut within the present enterprise setting.

Zscaler shares

ZS,

swung to a loss after hours about 10 minutes into ready remarks from Chief Executive Jay Chaudry, across the time he famous the corporate was executing nicely “while the macro environment remains challenging,” racking up accolades like gross margins above 80% and doubling annual recurring income to greater than $2 billion.

The inventory, which had been up as a lot as 5% proper after the discharge of earnings, was down as a lot as 3% through the name, after having completed the common session with a 2.8% achieve to shut at $162.74.

“The global macro environment remains uncertain,” Chief Financial Officer Remo Canessa additional defined, including that with rising financial uncertainty, they had been “mindful” on this setting that closing offers inside 90 days “remains challenging.”

FactSet

“From our perspective, the global macro remains uncertain and customers continue to scrutinize large deals,” Canessa instructed analysts. “In addition, in select instances, we will continue to enable new strategic customers to ramp into larger subscription commitments. Typically, these ramp deals reduce our first-year billings, but will grow into a higher annual run-rate level in the second year.”

The firm forecast adjusted earnings of about 48 cents to 49 cents a share on income of $472 million to $474 million for the fiscal first quarter. Analysts surveyed by FactSet had estimated 45 cents a share on income of $464.8 million and billings of $434.1 million for the quarter.

Zscaler forecast full-year earnings of $2.20 to $2.25 a share on income of $2.05 billion to $2.07 billion and billings of $2.52 billion to $2.56 billion. Analysts had forecast $2.11 a share on income of $2.05 billion and billings of $2.47 billion.

The firm reported a fiscal fourth-quarter lack of $30.7 million, or 21 cents a share, in contrast with a lack of $97.7 million, or 69 cents a share, within the year-ago interval. Adjusted web earnings, which excludes stock-based compensation and different gadgets, was 64 cents a share, in contrast with 25 cents a share within the year-ago interval.

Revenue rose to $455 million from $318.1 million within the year-ago quarter, the corporate mentioned, as billings grew 38% to $719.3 million.

The firm had forecast adjusted earnings of about 49 cents a share on income of $429 million to $431 million, whereas analysts surveyed by FactSet had estimated 49 cents a share on income of $430.4 million and billings of $657.5 million for the quarter.

As of Tuesday’s shut, Zscaler’s inventory is up 45.4% yr thus far, in contrast with a 17.1% achieve by the S&P 500

SPX,

a 34% enhance by the tech-heavy Nasdaq Composite

COMP,

and a 20.9% achieve by the ETFMG Prime Cyber Security exchange-traded fund

HACK,

Source web site: www.marketwatch.com